Not known Facts About Do I Have To List All My Debts When Filing Bankruptcy in Virginia

Bankruptcy is a robust lawful Instrument, but It's not at all a miraculous, heal-all. Filing for bankruptcy probably gained’t have the ability to resolve each monetary issue you’re struggling with and it may well not eliminate all of your debts.

Mail the creditor a copy from the bankruptcy discharge detect along with a well mannered created ask for to prevent all collection things to do and also to restore any credit history report inaccuracies that occurred through the incorrect assortment try.

Chapter 13 usually needs you for making month-to-month payments about A 3-calendar year to five-12 months interval prior to deciding to will get a discharge.

Access Monetary focuses primarily on loans for the objective of averting bankruptcy. The organization has an excellent standing, each with the BBB and its customers.

1 minute read • Upsolve can be a nonprofit that assists you get out of credit card debt with training and free personal debt reduction tools, like our bankruptcy filing Resource.

That by itself can be a significant worry aid. In addition, you get an opportunity to do a financial "reset" - although a painful a single. Which could aid You begin finding your money lifetime back again so as.

We deliver numerous possible clientele for an easy to get credit report from AnnualCreditReport.com. We also suggest that current clientele Verify their credit rating report annually, and dispute in crafting debts which they imagine must not surface on their own credit history report.

The most crucial purpose to include non-dischargeable debts, even though, is so your earnings and expense calculations will likely be precise. As talked about earlier mentioned from the part about keeping collateral, should you don’t include things like these debts, you may’t involve the amounts you purchase them every month in your list of expenses.

Secured debts are debts which have been backed by collateral, just like a residence or an automobile. Bankruptcy can erase your personal legal responsibility to pay back the personal debt, however it received’t erase the lien attached to your house. If you need to continue to keep a dwelling or motor vehicle which has a have a peek here dwelling house loan or automobile financial loan, Then you really have to pay the personal debt off.

Whether you have defalcation in your conscience or not, You will find there's big difficulty with failing to list fraudulent or intentional tort debts.

Reach Economic concentrates on financial loans for the objective of averting bankruptcy. The corporation has an excellent popularity, equally Together with the BBB and its purchasers.

A greater-than-average bankruptcy law firm will advise to you that while you need to attempt to avoid repayment of family and friends users to the eve of bankruptcy, it is best to figure out that just because you recently repaid a buddy or relative, that continue reading this repayment is usually not a motive, by alone, to postpone or steer clear of your bankruptcy filing.

Guaranteed! You might try receiving description a standard loan from the financial institution or credit rating union, borrow revenue from pals or spouse and children to pay back debts, or Focus on your aspect hustle for making additional income to address pay down Whatever you owe.

Bankruptcy is typically thought of as a “very last vacation resort.” Prior to a bankruptcy filing, it truly is common for financially troubled folks or entities to consider alternate options which include consumer credit counseling or an out-of-court work out or credit card debt restructuring in which obligations to some¬ or all creditors are modified to deliver the individual or entity news with some monetary aid.

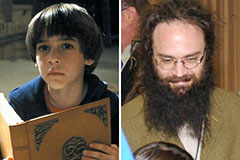

Barret Oliver Then & Now!

Barret Oliver Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!